Beginners may discover contributing frightening, however it’s an fundamental step in amassing riches and getting budgetary security. Investing for Beginnersgives a clear beginning point by clarifying basic concepts like chance resistance, expansion, and long-term arranging. This direct will offer assistance you make shrewd budgetary choices and construct the certainty required to develop your cash consistently.

1. Recognizing the Basics of Investing

Investing for Beginners: What is it?

Investing implies putting cash into things like property, budgetary items, or businesses to make a benefit. Contributing for tenderfoots points to offer assistance you develop your cash over time, whereas sparing centers on keeping your cash safe.

Why Is Contributing Necessary?

•Inflation: makes cash worth less as time goes by.. Contributing permits your cash to increment in esteem whereas holding its buying power.

• Riches Creation: Contributing can help you in coming to long-term budgetary targets such acquiring a domestic, giving for a child’s instruction, or resigning well.

• Detached Pay: Ventures can deliver inactive wage, which offers security and solidness in terms of money.

2. Recognizing Your Cash Objectives in Investing for Beginners

It’s critical to set your cash objectives some time recently you begin contributing. What are you contributing for, you inquire? (Retirement, tutoring, a critical buy, etc.)

How far off into the longer term do you require to arrange.(For a long time, a medium time, and a brief time) How much hazard can you handle. (Forceful, direct, and preservationist) Your contributing arrange and resource choice will be guided by the answers you provide.

3. Building up an Crisis Reserve

Be beyond any doubt you have an crisis support in put some time recently you begin contributing. This effortlessly open support should to be adequate to cover three to six months’ worth of living uses. It serves as a security net for accounts in the occasion of unanticipated costs or pay loss.

4. Speculation Vehicle Types in Investing for Beginners Guide

Purchasing offers in a enterprise entitles you to halfway ownership.

Benefits: Tall return potential and profit payments.

Cons: Showcase instability and expanded risk.

Bonds

Definition: Long-term advances that gather intrigued to a government organization or business.

Benefits: Steady salary and less hazard than stocks.

Drawbacks: Intrigued rate chance and decreased rewards.

Mutual Funds

Definition: A broadened portfolio of stocks, bonds, and other securities obtained with combined cash from a few investors.

Benefits: Proficient administration and diversification.

Cons: Potential beneath execution and administration costs.

Exchange-exchanged Stores (ETFs):

ETFs are characterized as common stores that are exchanged like individual stocks on stock trades.

Benefits: Assess proficiency, diminished expenses, and diversification.

Cons: Exchanging costs and showcase risk.

Property

Definition: Buying property, whether for businesses, homes, or renting.

Benefits: Appreciation, opportunity for steady pay, and substantial asset.

Cons: Advertise chance, administration obligations, and tall forthright expenditures.

Deposit Certificates (CDs)

Definition: Term and interest-rate-fixed investment funds accounts.

Benefits: Moo chance and guaranteed profits.

Cons: Punishments for early withdrawal and lower returns.

5. Comprehending Broadening and Risk in Investing for Beginners

Tolerance for Risk

How long you arrange to contribute, how you feel almost changes in the showcase, and your cash objectives all influence how much hazard you can handle.

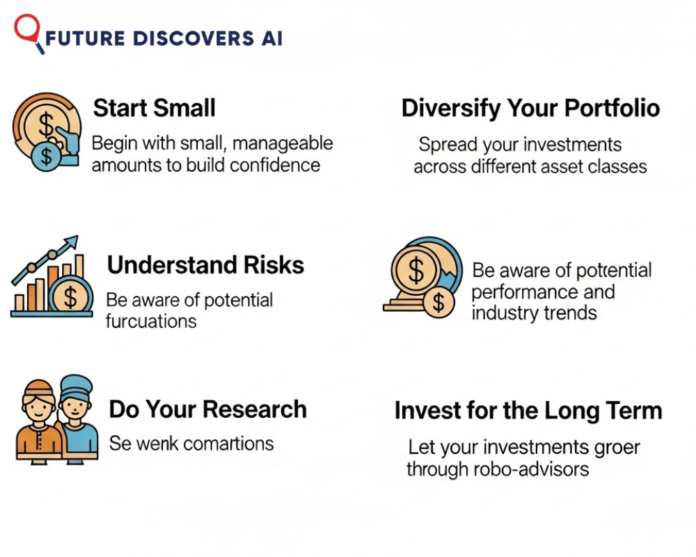

Diversification

To decrease chance, expansion implies spreading your speculations over distinctive sorts of resources. It is conceivable to moderate misfortunes from any one speculation by keeping up a broadened portfolio.

6. How to Invest First

Learn for Yourself

Study investing-related books, articles, and blogs. Look at selecting in an early on Contributing For Fledglings course.

Select a Financing Account

Brokerage accounts permit you to purchase and offer distinctive sorts of ventures, like bonds, stocks, and ETFs (which are reserves that exchange like stocks).

Retirement Accounts: Assess benefits are accessible for retirement investment funds in accounts such as 401(k)s and IRAs.

Choose a Broker

Investigate and differentiate brokerage houses.

Take into account components such as account minimums, speculation conceivable outcomes, expenses, and client support.Popular alternatives for amateurs are online brokers like Vanguard, Devotion, and Charles Schwab.

Start Small

Start with small speculations until you feel at ease with the strategy. Take into account robot-advisors, which offer reasonable, robotized venture management.

Consistent Donations

Add cash to your speculation account on a customary premise. Make utilize of dollar-cost averaging, which involves making standard speculations of a foreordained sum notwithstanding of advertise conditions.

7. Observing and Altering Your Portfolio Customary Reviews

Examine your portfolio on a standard premise (quarterly or yearly, for example

Adjusting

Re adjusting makes a difference control chance and ensures that your ventures stay in line with your destinations by adjusting your portfolio to protect your planning resource allocation.

Keeping up to Date:

Keep side by side of showcase improvements and monetary features. Keep learning around openings and strategies for investing.

8. Common Botches to Avoid in Investing for Beginners

Emotional Investing

Steer clear of contributing choices that are spurred by sentiments of ravenousness or fear. Keep to your long-term methodology and abstain from taking snap decisions.

Insufficient Enhancement Maintain a strategic distance from making all of your speculations with one finance. To appropriately control hazard, diversify.

Disregarding Charges: Recognize the costs associated to your investments.

Following Patterns: Abstain from taking after trends in contributing or well known stocks. Concentrate on a systematic, long-term plan.

9. Compound Interest’s Power

The control of compound intrigued is one of the most grounded contentions for starting contributing early. Compounding is the handle by which the returns on your speculations develop over time to deliver unused returns. If you begin contributing early, your cash can develop a parcel more over time.

10. Look for Proficient Advice

If you’re not beyond any doubt what to contribute in, think approximately talking to a authorized budgetary counselor. They can help you in creating a customized contributing procedure based on your destinations and level of chance tolerance.

Final Thoughts on Investing for Beginners

In conclusion, starting your venture travel may appear overpowering at to begin with, but with the right information and methodology, it can gotten to be both fulfilling and engaging. Investing for begginers is all approximately beginning little, broadening your ventures, and remaining reliable whereas persistently learning almost distinctive money related disobedient. Persistence, investigate, and teach are basic to minimize dangers and maximize returns over time. By setting clear objectives, understanding your chance resistance, and making educated choices, you can construct a solid money related establishment and slowly develop your riches.